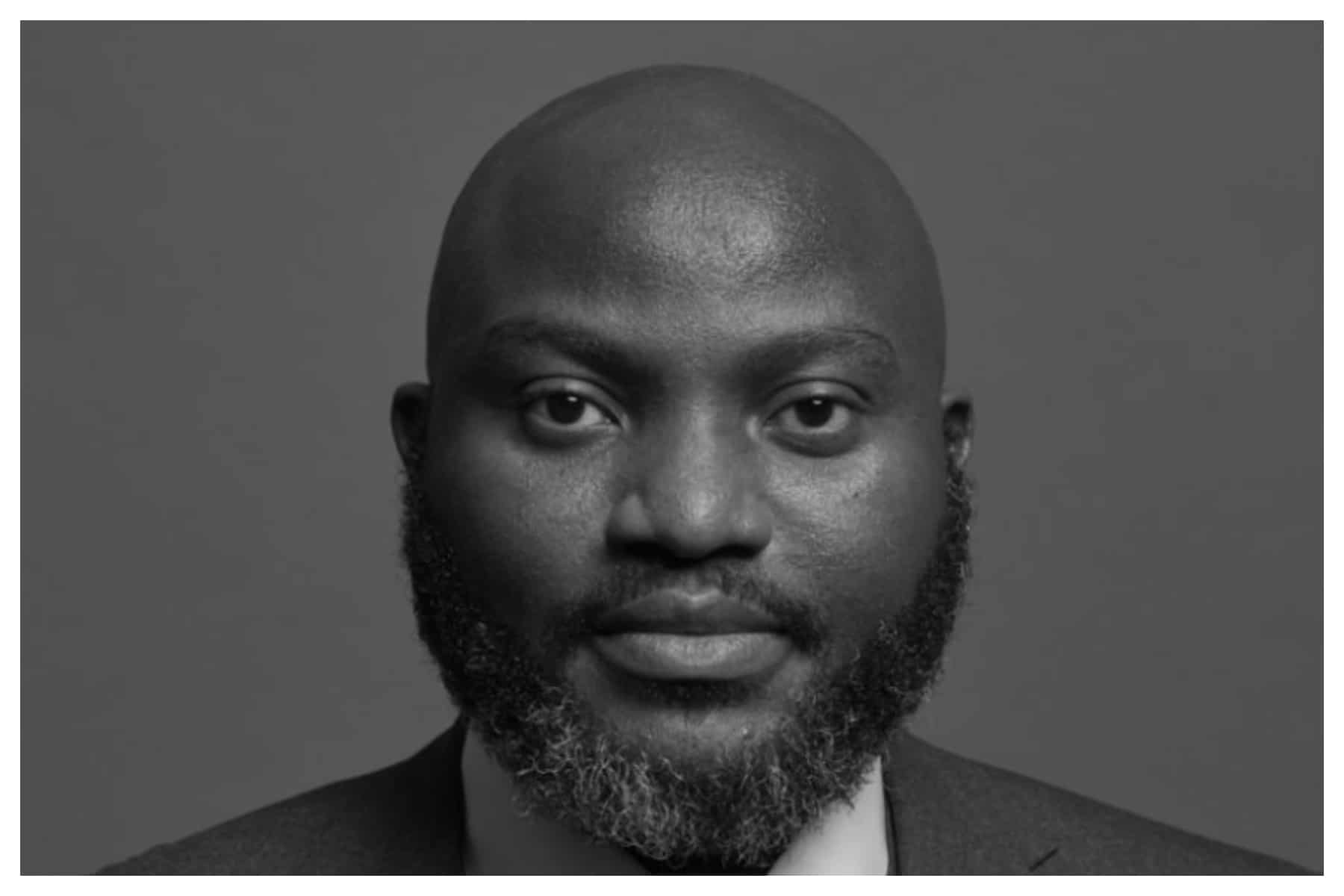

In a shocking revelation, the United States Securities and Exchange Commission (SEC) has exposed a major financial scandal involving Tingo Group Inc. and its Chief Executive Officer, Mmobuosi Banye, alias Dozy Mmobuosi.

The SEC announced on Monday that Tingo Group Inc. falsely claimed to have $461.7 million in its subsidiary, Tingo Mobile's Nigerian bank accounts, when, in reality, the accounts held a mere $50.

The SEC's charges extend to three affiliated U.S.-based entities, including Tingo Group Inc., Agri-Fintech Holdings Inc., and Tingo International Holdings Inc., all under the leadership of Mmobuosi. The commission alleges that Mmobuosi orchestrated a multi-year scheme to inflate the financial performance metrics of his companies and subsidiaries, deceiving investors worldwide.

In a press release issued on December 18, 2023, the SEC stated that it is seeking emergency relief to halt the defendants' dissemination of materially false information and to safeguard corporate and investor assets. The complaint accuses Mmobuosi of fabricating financial statements and misrepresenting business operations in press releases, SEC filings, and public statements since at least 2019.

A glaring example cited in the complaint is Tingo Group's fiscal year 2022 Form 10-K, filed in March 2023, which reported a cash balance of $461.7 million in Tingo Mobile's Nigerian bank accounts. However, the SEC alleges that the actual balance in those accounts was less than $50.

The complaint further asserts that Mmobuosi and the entities involved fraudulently obtained hundreds of millions through these deceptive practices, with Mmobuosi diverting funds for personal use, including luxury purchases, private jet travel, and an unsuccessful attempt to acquire an English Football Club Premier League team.

The SEC's case has been filed in the U.S. District Court for the Southern District of New York, charging the four defendants with violating federal securities laws' anti-fraud provisions. Specific charges against Mmobuosi include lying to auditors, insider trading, and failing to file necessary Forms 4, disclosing the sale of millions of Agri-Fintech common stock, for which he was the ultimate beneficial owner.

The SEC's actions underscore its commitment to maintaining market integrity and protecting investors from fraudulent activities.