China's economy made a stronger-than-expected start to the year, even as the crisis in its property sector deepened.

According to official data, gross domestic product (GDP) expanded by 5.3% in the first three months of 2024, compared to a year earlier.

That beat expectations the world's second-largest economy could see growth slow to 4.6% in the first quarter.

Last month, Beijing set an ambitious annual growth target for the world's second-largest economy of "around 5%".

Data from the National Bureau of Statistics (NBS) also showed first-quarter retail sales growth, a key gauge of China's consumer confidence, fell to 3.1%.

"You cannot manufacture growth forever so we need to see households come to the party if China wants to hit that around 5% growth target," Harry Murphy Cruise from Moody's Analytics told the BBC.

In the same period, property investment fell by 9.5%, highlighting the challenges faced by China's real estate firms.

The figures came as China struggles with an ongoing property market crisis. According to the International Monetary Fund (IMF), the sector accounts for around 20% of the economy.

The latest data also showed new home prices fell at the fastest pace for more than eight years in March.

The real estate industry crisis was highlighted in January when property giant Evergrande was ordered to liquidate by a court in Hong Kong.

Rival developers Country Garden and Shimao have also been hit with a winding-up petition in the city.

Last week, credit ratings agency Fitch cut its outlook for China, citing increasing risks to the country's finances as it faces economic challenges.

At the annual gathering of China's leaders in March officials said the economy grew by 5.2% in 2023.

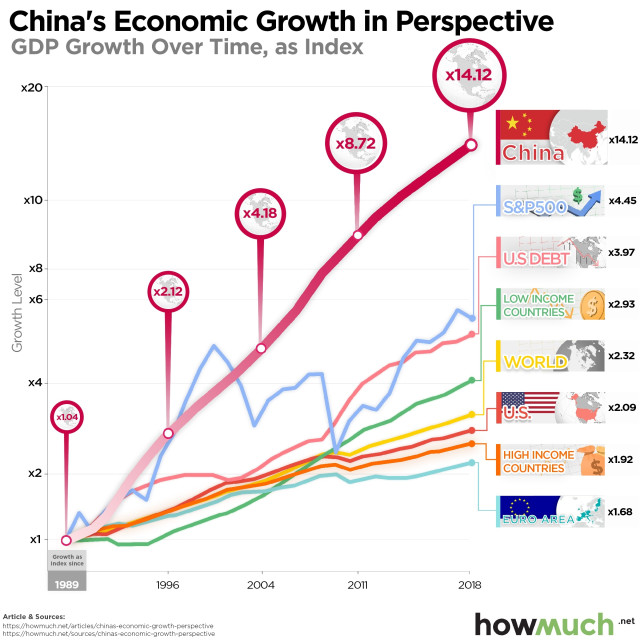

For decades the Chinese economy expanded at a stellar rate, with official figures putting its GDP growing at an average of close to 10% a year.