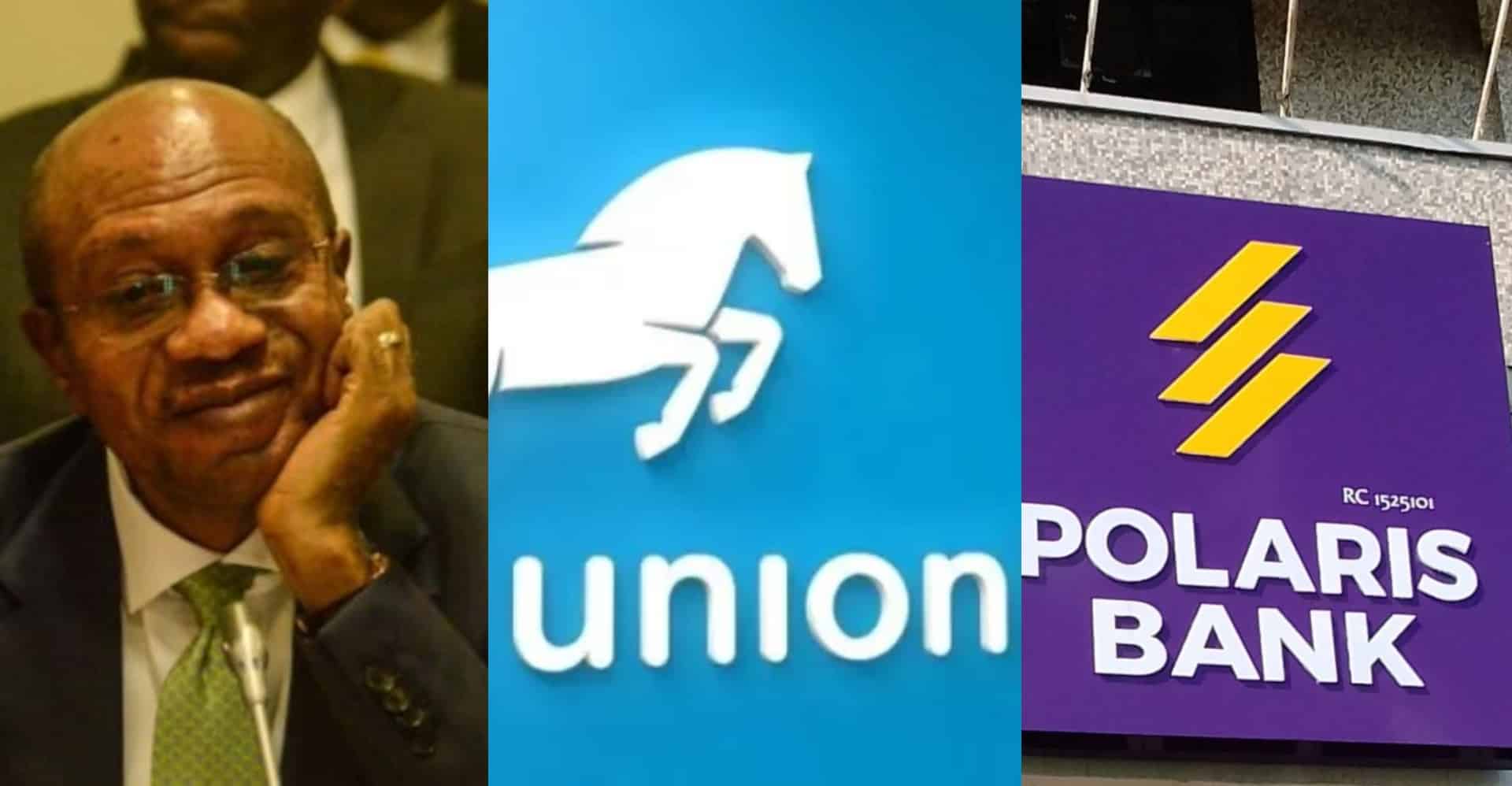

Former Governor of Central Bank, Godwin Emefiele has been accused of illegally acquiring Union Bank of Nigeria, Polaris and Keystone Bank.

According to a recent report by Jim Obazee, the special investigator appointed by President Bola Tinubu, the ex-CBN governor used proxies to acquire these banks.

Tinubu appointed Obazee, the Chief Executive Officer of the Financial Reporting Council of Nigeria to lead the investigation on the apex bank during Emefiele's tenure.

While the full report remains confidential, Daily Trust has obtained details on the alleged irregularities surrounding the takeovers of Union Bank, Keystone Bank, and Polaris Bank.

Union Bank Acquisition:

- The report alleges that Titan Trust Bank (TTB) served as a "Special Purpose Vehicle" for Emefiele's acquisition of Union Bank through proxies.

- TTB reportedly sought CBN approval for a four-phase acquisition plan, involving buying 91.5% of Union Bank's shares, a mandatory tender offer, and a merger.

- Funding was secured through a debt and equity combination, including a $300 million loan from Afrexim Bank and capital injection from Dubai-based entities.

- The report claims Emefiele used "ill-gotten wealth" to finance the acquisition through proxies and predicts forfeiture of both Union Bank and TTB by the government.

Keystone Bank Acquisition:

- The investigation reveals that individuals linked to Emefiele and the late Alhaji Ismaila Isa Funtua acquired Keystone Bank without evidence of payment.

- Heritage Bank reportedly provided an N25 billion loan to the acquisition group, backed by Keystone Bank shares and later repaid by internal loans.

- These internal loans, exceeding N50 billion, are now considered bad debts, jeopardizing the bank's stability.

- The report suggests Keystone Bank was essentially acquired for free, similar to Polaris Bank's alleged takeover.

Further Investigations and Unanswered Questions:

- The special investigator is currently interrogating the AMCON MD to clarify the acquisition process for all three banks.

- Union Bank and Polaris Bank have yet to respond to the report's allegations, while Keystone Bank's reaction remains unknown.