The Vice President of African Development Bank (AfDB) has said the approval of the payment of $1.3 billion, and N1.3 trillion power sector debts by President Bola Ahmed Tinubu is expected to attract investments.

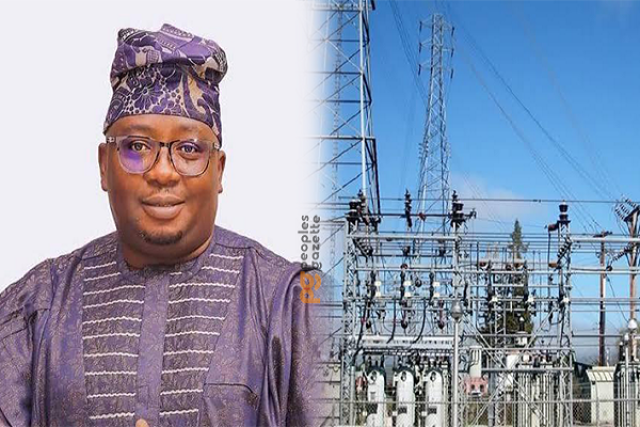

The Minister of Power, Adebayo Adelabu, confirmed that the Federal Ministry of Finance has followed through on the President's approval by paying N130 billion to gas suppliers from the gas stabilization fund.

Gas suppliers are owed $1.3 billion, while generating companies are owed N1.3 trillion. Dr. Kariuki believes that this development will greatly encourage investors.

In addition, the Chairman of the Nigerian Electricity Regulatory Commission (NERC), Sanusi Garba, highlighted that most of the distribution companies (DisCos) are technically insolvent. He stated that many DisCos are facing corporate governance issues and high levels of losses, particularly impacting consumers.

These statements were made during the eighth African Energy Market Place, which focused on "Towards Nigeria's Sustainable Energy Future: Policy, Regulation, and Investment – A Policy Dialogue for the National Integrated Electricity Policy and Strategic Implementation Plan (NIEP-SIP)."

Adelabu clarified that the payments were intended to settle both existing and previous debts. He stated, "An approval has been granted for the payment of approximately N130 billion from the gas stabilisation fund to address the current debt, which will be handled by the Federal Ministry of Finance, if it has not already been settled."

Furthermore, Adelabu outlined that the legacy debt would be addressed using future royalties and income from the gas subsector. He emphasized that clearing the $1.3 billion debt owed to gas suppliers would incentivize companies to engage in gas-supply contracts with GenCos.

He expressed concern about the lack of firm contracts between gas companies and most GenCos, highlighting the absence of penalties for non-supply.

He emphasized the importance of establishing firm contracts to ensure consistent gas supply to power generating companies. Adelabu also mentioned that President Tinubu has approved the payment on the condition of reconciling the outstanding amount.

He disclosed that while most companies have agreed to the terms, efforts are ongoing to secure 100% agreement from all parties involved.

Adelabu stated that there will be an immediate infusion of cash while the government resolves the remaining portion with a guaranteed debt instrument, preferably through a promissory note.

"This will greatly encourage power-generating companies and motivate them to further invest in generation.

"There is potential for demand both locally and internationally, leading to foreign exchange earnings for the country," he explained.

Adelabu also mentioned that the Band A electricity tariff, which took effect on April 3, has reduced production costs by 40 percent, although he did not provide further details.

He further added that the Nigerian Electricity Supply Industry (NESI) achieved a new milestone of 5,000MW over the last three years with the generation of 700MW from the Zungeru hydroelectric power plant.

AFDB Vice President overseeing the Power, Energy, Climate Change & Green Growth Complex, Kariuki, emphasized Nigeria's substantial market for electricity demand.

"Clearing debts to GenCos will have a significant impact on investment. The uncertainty and risk of non-payment have been deterrents for some. Nigeria's substantial electricity demand will boost confidence in the country. This will attract more investors and enable them to secure financing suitable for Nigeria," he stated.

House of Representative Speaker, Tajudeen Abbas, expressed that the capital needed for power sector development is excessively high and urged the AfDB to allocate more funding to the transmission sub-sector.

The AfDB Vice President highlighted that projects are always assessed based on their feasibility.

"The bank is prepared to finance projects in accordance with the country's annual entitlement," he assured.