Nigeria’s fintech platform, PalmPay, said its focused would target underserved community to drive financial inclusion and empowerment.

Its focus, according to the firm, would be centred on scaling innovations and delivering reliable financial solutions to underserved communities across Nigeria.

Speaking at the company's fifth anniversary in Lagos, PalmPay’s CEO, Mr. Chika Nwosu, underscored the company's relevance in adopting technology tools to solving financial challenges.

He said, “Five years ago, we entered Nigeria’s fintech space with the dream of becoming Africa’s largest financial services platform.

“It wasn’t an easy journey, but with the support of our team and loyal users, we have impacted the lives of over 35 million people across Nigeria and beyond.

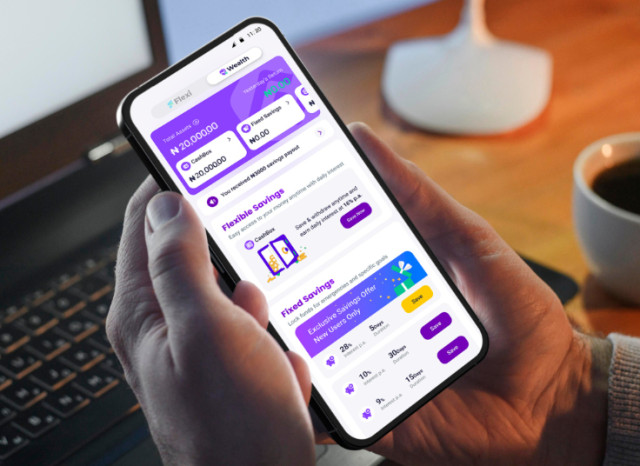

“Since its inception, PalmPay has provided critical financial products such as money transfers, bill payments, credit services, and savings solutions.

“It has established a robust network of over 1 million mobile merchants and agents. This wide reach has contributed significantly to the nation’s financial inclusion, helping Nigeria achieve a 74 per cent financial inclusion rate last year”.

Highlighting PalmPay’s recent efforts, Nwosu introduced the *864# feature, an innovation that allows users to access financial services without the need for a smartphone.

“This solution reflects our deep understanding of local needs and our ongoing commitment to delivering real, accessible financial solutions for all Nigerians,” Nwosu said.